In M&A deals involving S corporations, it has become popular to engage in pre-transaction restructuring by making use of an ”F” Reorganization.

This provides the opportunity for the parties to receive the tax benefits provided by a purchase with a Section 338(h)(10) election without having to go through the election which has a number of requirements that may not be easily met.

The F reorganization also allows the target company to continue to use the same employer identification number which may be important in many cases.

See our article on S Corporations and Section 338(h)(10) elections for background information.

What is an F Reorganization

Section 368(a)(1)(F) of the Internal Revenue Code defines an F Reorganization as “a mere change in identity, form, or place of organization of one corporation.”[1]

Regulations further qualify that definition by stipulating that the corporation involved “must not change its capital structure, its assets, its business, or its shareholders.”[2]

If a reorganization transaction meets the requirements, it will receive tax-free treatment.

What are the steps?

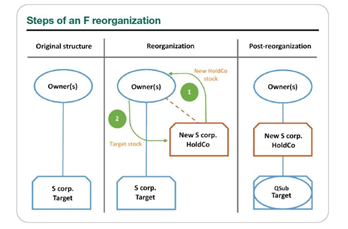

- The shareholders of the target S corporation (Target) form a new corporation (Holdco) by contributing shares of Target to Holdco in exchange for all of the shares of the Newco.

- Target elects to become a qualified Subchapter S subsidiary (QSub) which is a disregarded entity for federal income tax purposes (See our article about Disregarded Entities).

The QSub election results in a deemed tax-free liquidation of Target into Holdco. The IRS has also published rulings to indicate that S corporation status of Target will be extended to Holdco. (See, for example, IRS Revenue Ruling 2008-18).

The above can be accomplished on a tax-free basis because the transaction should be considered an “F” Reorganization.

Another common step after the F Reorganizations steps above is to convert Target from a corporation to a limited liability company (LLC) under state law.

As an LLC that only has one owner (Holdco), Target will continue to be viewed as a disregarded entity for federal income tax purpose and the conversion will therefore have no tax consequences.

Among other things, this extra step would protect the buyer’s step-up in Target’s assets should it is later determined that Target inadvertently did not qualify as an S corporation in the past or that Target did not properly execute the QSub election.

The diagram below shows a visual representation of Steps 1 and 2:

Credit: The Tax Adviser https://www.thetaxadviser.com/issues/2020/aug/state-local-considerations-f-reorganization-acquisition.html

State and Local Issues

All of the tax consequences of “F” reorganizations described in this article thus far, such as a step-up in basis or zero recognition of gain or loss, are specific to federal tax consequences.

However, it is equally important to consider the various tax consequences that F reorganizations may have in different states. For example, some states require companies to file separate S corporation status elections and QSub elections for in-state tax purposes or they may tax gains on “F” reorganizations differently. Others, such as California, require separate taxes on QSubs.[3]

Role of a Tax Advisor

An “F” Reorganization pre-transaction restructuring can create a lot of tax benefits for the parties involved.

However, it implicates a lot of complex tax rules each of which has to be properly complied. An experience M&A tax advisor will be invaluable to assist in the planning and execution of the strategy.

[1] IRC § 368(a)(1)(F).

[2] 26 CFR §1.368-2.

[3] Hannah M. Prengler & Sara Britt, State and local considerations in using an F reorganization to facilitate an acquisition, The Tax Adviser (Aug. 1, 2020), https://www.thetaxadviser.com/issues/2020/aug/state-local-considerations-f-reorganization-acquisition.html.