FIRPTA can significantly diminish returns on investments to foreign investors!

The Foreign Investment in Real Property Tax Act of 1980 (“FIRPTA”) imposes a 21% capital gains tax on foreign investors who sell or dispose of US real property interests (“USRPIs”). Shares in a corporation can be USRPIs if the corporation holds USRPIs equal to 50% or more of the sum of the fair market values of its USRPIs, its interests in real property located outside the US, and trade or business assets (“USRPHC”).

Many transactions can trigger FIRPTA withholding – some are unexpected!

Leo Berwick’s FIRPTA team has a wide breadth of experience advising investment funds on tax issues related to their US investments. With over 150 years of combined experience, our team has advised hundreds of clients on FIRPTA issues and can ensure you are protected during tax due diligence, compliant during your holding period, and prepared for a future sale.

This team is part of a broader interdisciplinary team of more than 35 ex-Big 4 and Big Law advisers providing investors with practical, responsive commercial tax advice with deep expertise in tax, valuation, and modeling.

What We Can Do For You.

The industry-leading Leo Berwick team is multidisciplinary and includes tax, modeling, and valuation experts. We are nimble and can move quickly to provide comprehensive advice, helping you navigate the FIRPTA landscape.

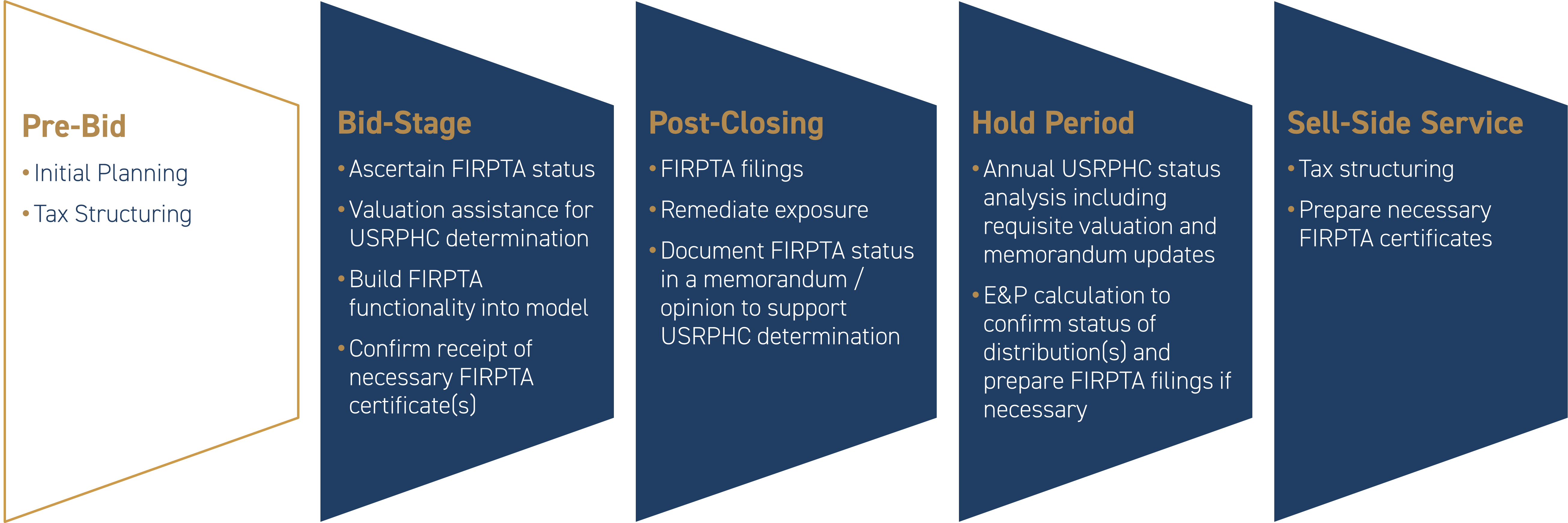

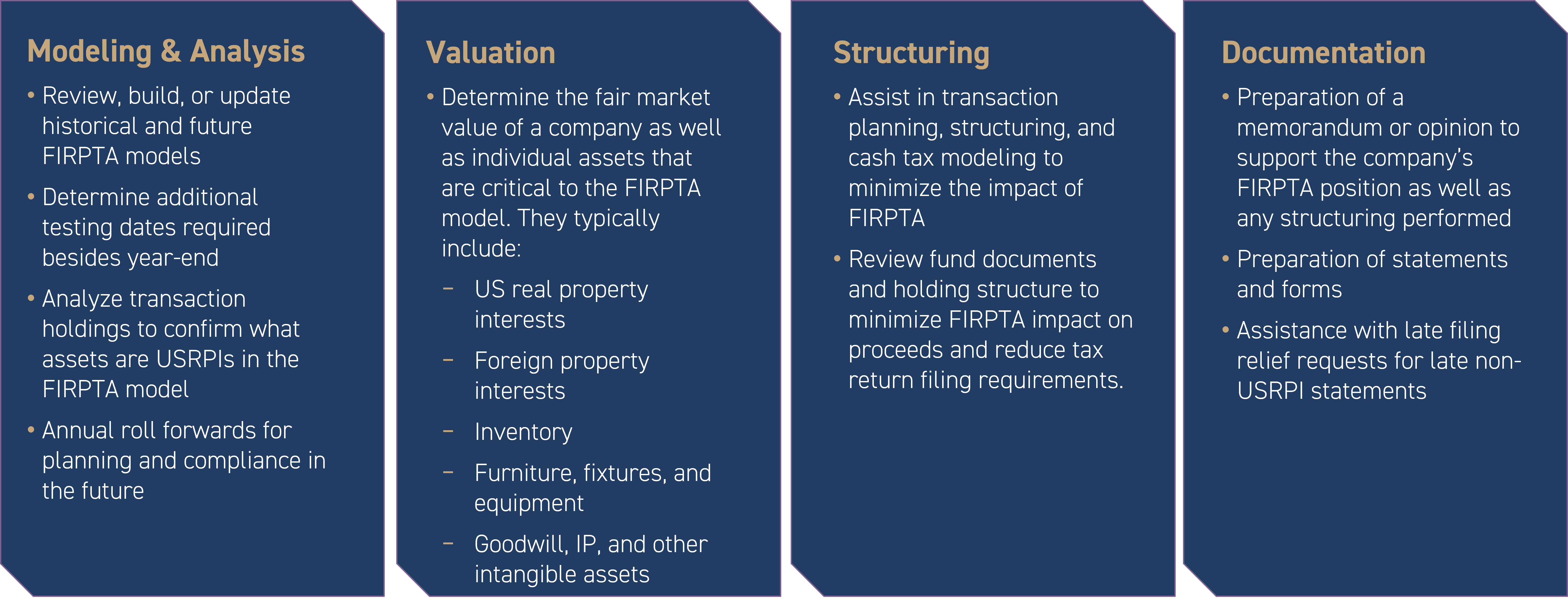

Supporting Every Part Of Your FIRPTA Journey

Additional Details on Our Services

FIRPTA: A Real World Example

What Happened

- Fund B, with only non-US investors, formed Corp X on June 1, 2020, contributing capital of $4m.

- Corp X bought land for $1m to build its wind farm on November 1, 2020 and used most of the remaining capital to construct the wind turbines and other infrastructure.

- Corp X began operating the wind farm on May 1, 2021.

- On June 1, 2021, when Corp X did not have any earnings and profits, Corp X made a distribution of $600K to Fund B.

- Corp X had a great first year!

- Fund B started planning its exit on in early 2023 and put Corp X on the market, expecting $5m of proceeds.

- After tax due diligence, the potential buyer informed Fund B that Corp X had a significant US tax exposure because it was a USRPHC and had not complied with the FIRPTA rules.

What Buyer Found

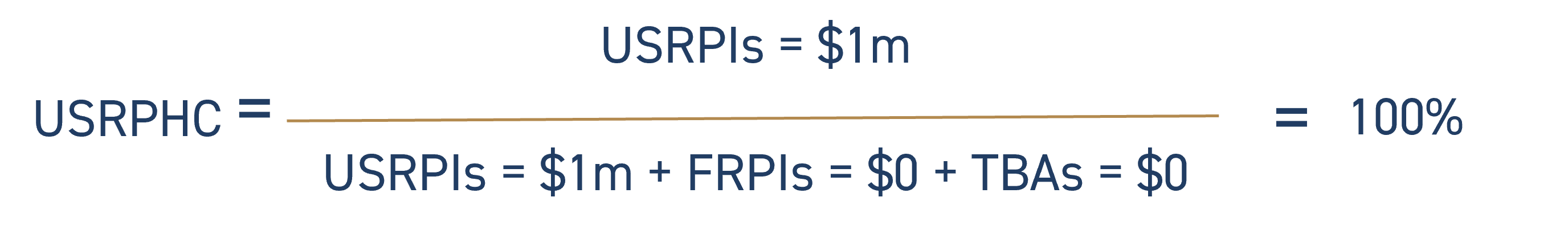

- On November 1, 2020, when Corp X bought the land, it became a USRPHC

- Corp X owned US real estate worth $1m and had no trade or business assets because it had not begun operating the wind farm when it acquired the land. Because Corp X had not commenced operations, it had no trade or business assets, so its USRPHC determination percentage was 100%.

- When Corp X made the $600K distribution to Fund B, Corp X did not have any earnings and profits, so the distribution was a return of capital. Because Corp X was a USRPHC, Corp X should have withheld $90K (15% of the distribution) and remitted that amount to the IRS.

- The withholding could have been avoided had Corp X applied for a withholding certificate (on Form 8288-B) from the IRS.

In 2023, Corp X shares remained USRPIs because of the 5-year USRPHC rule.

- Buyer must withhold $750K (i.e., 15% of the $5m gross purchase price) and remit to the IRS, even though Fund B’s gain was only $1.6m ($5m proceeds less $4m original investment less $600k return of capital distribution). The Fund investors only owed $336k!

- To receive the balance of their proceeds, the Fund B investors must file a US tax return to claim a refund.

Recent Insights

Repowering Renewables and the 80/20 Test

In this episode, Dorian Hunt, Renewables Leader at Leo Berwick, is joined by valuation experts Mike Bammel and Rick Ellsworth to explore the concept of project repowers and the application of the 80/20 test. The discussion centers on how previously placed-in-service...

Leo Berwick supports Bluebird Fiber with its announced stalking horse bid to acquire Everstream’s remaining operations

June 5, 2025 Leo Berwick is proud to support Bluebird Fiber, a Macquarie Asset Management portfolio company, in its announced stalking horse bid to acquire Everstream’s remaining enterprise fiber operations across several Midwestern U.S. states. Read More

Leo Berwick supports Gauge Capital with its acquisition of two Delta Research Partners sites

May 19, 2025 Leo Berwick is proud to have supported Gauge Capital and Rovia Clinical Research with its acquisition of two DELTA RESEARCH PARTNERS, LLC sites in Bastrop and West Monroe, supporting an expansion of research access throughout the Northern Louisiana...

Let’s work together.

You want an M&A expert who gets it. A commercially minded expert who understands deals. A partner who shares your drive for minimizing risk, maximizing value, and accelerating returns.

That’s Leo Berwick. The first call you make for any deal.