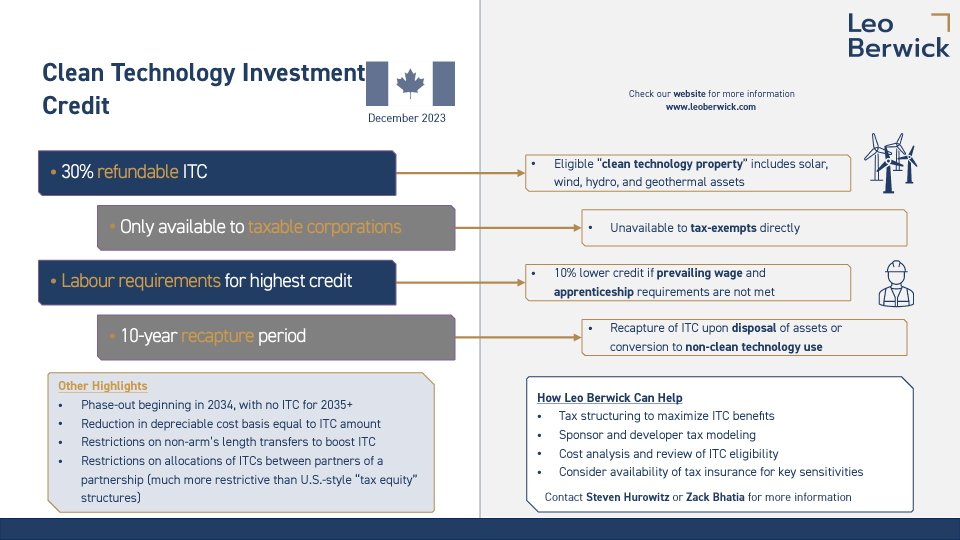

On November 30, 2023, Deputy Prime Minister and Minister of Finance Chrystia Freeland tabled Bill C-59 in the House of Commons (the “Bill”). The Bill includes legislation to implement the new Clean Technology Investment Tax Credit (“ITC”) first introduced in Budget 2023.

Leo Berwick has analysed the Clean Technology measures in the Bill and summarised the highlights below. If you have further questions about the Bill or the Clean Technology ITC, please contact Steven Hurowitz, Partner (steven.hurowitz@leoberwick.com) and Zack Bhatia, CPA, Vice President (zack.bhatia@leoberwick.com).

1. Updates from August 4, 2023 Proposals

Legislative proposals for the Clean Technology ITC were first issued on August 4, 2023 (the “August Proposals”). The Bill includes a number of significant changes from the August Proposals. The most significant change relates to Clean Technology ITCs earned in limited partnership special purpose vehicle (“LP SPV”) structures.

Leo Berwick Insights: Clean technology and other renewable energy projects have typically been carried in LP SPVs. LP SPVs were favoured for a number of reasons, notably they facilitated debt financing and partnering with tax-exempt investors, in particular First Nations bands. Under the Bill, a taxable limited partner may only claim the Clean Technology ITC to the extent of its “at-risk” amount in the LP SPV, which is generally the extent of its investment, less distributions, plus and minus taxable income/loss allocations. We understand that the Department of Finance (“Finance”) viewed this limitation as a relieving measure as the August Proposals had effectively limited the Clean Technology ITC allocated to a limited partner to an expenditure base that was effectively 30% of that partner’s at-risk amount (the “Expenditure Base Limitation”), rather than its greater at-risk amount. But what Finance giveth it also has taken away. The August Proposals contained a relieving mechanism that allocated to the general partner of the LP SPV any portion of the maximum 30% Clean Technology ITC that could not be claimed by its limited partners due to the Expenditure Base Limitation. This effectively provided a mechanism for the full 30% Clean Technology ITC to be claimed. The Bill no longer includes this relieving mechanism.

The following tables illustrate the potential limitation in a leveraged LP SPV structure under the Bill vs. the August Proposals.

In Table 1 it is assumed that all limited partners are taxable Canadian corporations (“TCCs”) and clean technology expenditures of $100,000 are financed 20% by way of equity and 80% by way of debt. Under the August Proposals, it was expected that a Clean Technology ITC of $30,000, being 30% of eligible expenditures in this example, could have been claimed. However, under the Bill, the Clean Technology ITCs will be limited to the equity financing of $20,000. In Table 2 the facts are the same except Tax Exempt LP2 instead of TCC LP2 is a limited partner. Under the August Proposals it was still expected that a Clean Technology ITC of $30,000 could have been claimed. However, under the Bill the Clean Technology ITCs will be limited to the equity financing of the TCCs being only $10,010.

Given the traditional use of the LP SPV structure to own and operate renewable projects, the revised “at-risk” limitations could potentially significantly limit the Clean Technology ITC program’s stated legislative objective of encouraging the investment of capital in the adoption and operation of clean technology property in Canada, particularly in highly leveraged projects.

As such, to obtain maximum entitlement to the Clean Technology ITC, it appears that projects held in LP SPVs should at least be equity-financed in amount equal to the anticipated ITC. Leo Berwick can assist with analyzing the tax implications of other potential solutions including carrying on the clean technology project in general partnership and/or corporate form.

We have highlighted other significant changes to and features of the Clean Technology ITC further below.

2. 2023 Fall Economic Statement (the “Economic Statement”)

The Bill follows the presentation of the Economic Statement that was released on November 21, 2023. Prior to the delivery of the Economic Statement, there was considerable uncertainty regarding the timeline for the delivery of legislative details for several of the clean investment tax credits proposals. The Economic Statement announced certain new clean investment initiatives and included a welcome update on the Government’s expected timeline to deliver and implement legislation to enact the Clean ITC proposals.

The following table summarizes the Government’s intended timelines: Notes

1 Maximum ITC rate available for eligible expenditures, if certain criteria met

2 For projects the did not begin construction before March 28, 2023.

N/A – not applicable

3. Clean Technology ITC Calculation

Like many existing and historical ITCs in Canada, the Clean Technology ITC is computed by multiplying the applicable tax credit rate by the capital cost of eligible property. In the case of the Clean Technology ITC, the “regular” tax credit rate is 30% for eligible property acquired on or after March 28, 2023. The tax credit rate is reduced to 15% for property acquired in the 2034 calendar year and is fully reduced to nil for property acquired in 2035 onwards.

The above references a “regular” tax credit rate. As discussed further below, taxpayers must elect into various labour requirements in order to qualify for the regular tax credit rates. These labour requirements were briefly mentioned in Budget 2023 and mimic the U.S. labour requirements introduced as part of the Inflation Reduction Act in 2022. Failure to elect into and qualify for these requirements results in the taxpayer only being eligible for the “reduced” tax credit rate. The reduced tax credit rate is generally 10% lower than the regular tax credit rate (i.e., 20% until 2034, and 5% in 2034).

4. Eligible Cost The Clean Technology ITC benefit is a function of the capital cost of “clean technology property” acquired by the taxpayer in the year. Consistent with Budget 2023, clean technology property includes (but is not limited to):

- Wind and water energy conversion systems, including wind-driven turbines, control and condition equipment, support structures, powerhouse, and certain transmission equipment;

- Active solar heating equipment, air-source heat pumps and ground-source heat pumps;

- Fixed location solar photovoltaic equipment, including solar cells or modules and related equipment including inverters, control and conditioning equipment, support structures and certain transmission equipment;

- Concentrated solar energy equipment, including electrical generating equipment, solar reflectors, thermal receivers, thermal energy storage equipment, heat transfer fluid systems, and certain transmission equipment;

- Hydro-electric installations, including electrical generating equipment, canals, dams, dykes, overflow spillways, penstocks, powerhouse, control equipment, fishways or fish bypasses, submerged cable equipment, and certain transmission equipment;

- Geothermal equipment used for the purpose of generating electrical energy, heat energy, or a combination of both, excluding equipment that also extracts heat from fossil fuels. The August Proposals included an exclusion for equipment that is part of the system that extracts both heat from a geothermal fluid and fossil fuel for sale. The reference to geothermal fluid was eliminated in the Bill;

- Batteries and certain other fixed location energy storage property that do not directly use any fossil fuel in their operations; and

- Non-road zero-emission vehicles and charging stations.

Additional requirements in the Bill include that clean technology property must be situated in Canada, must be intended for use exclusively in Canada, and must not have been used or acquired for use for any purpose before it was acquired by the taxpayer.

Key costs and reimbursements that are excluded from the capital cost for purposes of the Clean Technology ITC include:

- Capitalized interest and financing fees;

- Certain additional costs arising from non-arm’s length transactions (see further below); and

- Government assistance or non-government assistance that can reasonably be considered to be received or receivable in respect of the property.

Certain other costs may be excluded depending on the nature of the “clean technology property”. That is, excluded costs may comprise:

- “Distribution equipment”, which generally includes transmission lines and other equipment that is used to transmit 75% or less of the annual electricity energy generated by the electrical generating equipment. Note that such equipment that is used to transmit more than 75% of the annual electricity energy generated is considered to be “transmission equipment” and is generally eligible for the Clean Technology ITC;

- Buildings or structures, except structures whose sole function is to support or house concentrated solar energy equipment.

For the purpose of determining whether a property is a clean technology property, any technical guide published by the Department of Natural Resources (“NRC”) is to apply conclusively with respect to engineering and scientific matters. NRC already publishes the technical guides for Class 43.1 and 43.2 property, which are the starting point for the definition of “clean technology property”.

Leo Berwick Insights: Investors will want to ensure that their claims are supported with detailed cost studies/analyses to ensure that all Clean Technology ITC eligible costs are identified.

The NRC Technical Guide to Class 43.1 and 43.2 includes detailed listing of costs and schematic diagrams that provide helpful clarification on eligible vs. ineligible costs by type of clean technology property.

Based on our experience in the U.S., we would also expect tax insurance to begin to play more of a role in renewable energy deals in Canada on a go-forward basis to protect against the risk of credit eligibility being challenged. Key areas of sensitivity are the Clean Technology ITC eligibility of costs incurred as well as any premiums to cost basis that are created on transfers between parties, in particular where such parties have common ownership.

The Economic Statement issued on November 21, 2023 also proposed to expand eligibility for the Clean Technology ITC to include systems that use specified waste materials solely to generate electricity or both electricity and heat (i.e., cogeneration). The Bill does not include amendments to implement this proposal. Finance indicated in the Economic Statement that it is targeting to introduce applicable legislation in fall 2024.

5. Basis Reduction

The Bill provides that the depreciable tax basis for the particular property will be reduced by the Clean Technology ITC claimed. E.g., for $100 of eligible costs, assuming that a 30% Clean Technology ITC is claimed, a taxpayer will reduce the depreciable basis in the particular property by $30 and therefore will be able to claim depreciation benefits on only $70. A similar reduction also applies to reduce the adjusted cost base of a partner’s interest in a partnership by the partner’s allocable share (see below) of the Clean Technology ITC generated from the partnership’s clean technology property.

6. Eligible Taxpayers

The Bill provides that the Clean Technology ITC is meant to be available only for TCCs, which excludes the ability for tax-exempt entities (e.g., registered pension funds, Crown corporations, First Nations bands) to claim the Clean Technology ITC directly. However, the Bill does not provide any difference in treatment for TCCs controlled by tax-exempt entities or non-residents.

7. Interaction with Limited Partnerships

The Bill provides the Clean Technology ITC mechanics for eligible costs incurred by partnerships. Under these mechanics, eligible costs are determined at the partnership level and allocated to eligible TCC partners in an amount that can be reasonably considered each partner’s share of the Clean Technology ITC. The Clean Technology ITC is then claimed at the partner level. However, a limited partner may only claim the Clean Technology ITC to the extent of its at-risk amount, which is generally the extent of their investment, less distributions, plus and minus income allocations.

Similarly, recapture events can also be triggered based on activities by the partnership (e.g., a disposal of the assets), however the consequences of the recapture (i.e., repaying Clean Technology ITCs) will occur at the partner level.

Additionally, the Bill includes general anti-abuse provisions regarding disproportionate allocations of Clean Technology ITCs between partners.

Leo Berwick Insights: The Budget implied that the credit would be unavailable to tax-exempts, so this is no surprise. Therefore, tax-exempt investors in energy assets will need to consider the trade-off between (i) investing through TCCs to provide access to the Clean Technology ITC, versus (ii) investing in flow-through form to take advantage of tax-exempt status. This is a modeling exercise that Leo Berwick can assist with.

As currently drafted, the at-risk rules in the Bill restrict the ability for a taxable limited partner in a LP SPV to claim the Clean Technology ITC in highly-leveraged projects; as such, to obtain maximum entitlement to the Clean Technology ITC, it appears that projects held in LP SPVs should at least be equity-financed in amount equal to the anticipated ITC. The Clean Technology ITCs can be allocated between the partners in a manner that reasonably can be considered to reflect those partners’ share of the Clean Technology ITC. Factors such as the capital invested or other work performed could impact the reasonable allocations. This could present the opportunity for some flexibility in allocating the Clean Technology ITC between a developer and a purely economic investor, for example. While the Canadian rules seem too restrictive for U.S. “tax equity” style investment structures, there could still be opportunity for third party investors to contribute capital to energy projects in exchange for access to a large portion of the upfront tax benefits (Clean Technology ITC and tax depreciation benefits). This is something that Leo Berwick will be exploring over the coming months.

8. Refundability

As mentioned, the Clean Technology ITC is proposed to be refundable. This means that the Clean Technology ITC will not only offset the taxes otherwise owed by the taxpayer but will also generate a tax refund to the extent that the Clean Technology ITC exceeds the taxes otherwise owing.

9. Timing of Clean Technology ITC

The Bill provides that, while eligible costs may be incurred throughout the construction period, the Clean Technology ITC is only available to be claimed once the property is available for use. Typically, we would expect this date to be as of the substantial completion (SC) date when it has been demonstrated that the property is capable to be used for its intended purpose.

10. Tax Shelter Investment Rules

The Clean Investment ITC is not available if the acquisition of the clean technology property or the investment vehicle (e.g. LP SPV) is considered a tax shelter investment.

11. Recapture

Generally, if the Clean Technology ITC is claimed on property and such property undergoes a recapture event within the recapture period, some or all of the Clean Technology ITC originally claimed will be deemed to be owed and must be repaid back to the CRA. These rules appear to operate similarly to existing ITCs and in some ways mimic the rules in the U.S.

The recapture period in the Bill is 10 calendar years following the year of acquisition of the Clean Technology ITC property. The Bill includes the following recapture events:

- The property is exported from Canada;

- The property is disposed of (some exceptions for certain transfers between related parties); or

- The property converts to a non-clean technology use, which includes events that would cause the property to no longer meet Clean Technology ITC eligibility criteria (e.g., it is disassembled or no longer used to generate solar, wind, or water energy, it begins to be used to produce or co-produce fossil fuel energy, etc.).

The recapture amount (not to exceed the original Clean Technology ITC) is determined formulaically by multiplying the original Clean Technology ITC claimed by the ratio of the proceeds (if the property is disposed of to an arm’s length person) or fair market value of the asset at the recapture date (in any other case) over the original capital cost. For example, if the property was disposed of within the recapture period at an amount equal to 80% of its original capital cost, then 80% of the original Clean Technology ITC will be recaptured (regardless of when the asset is disposed of within the 10-year recapture period – e.g., year 9 vs. year 3 would provide for the same recapture).

Similarly, if there was a change in use of the asset, the fair market value of the asset at the time would be compared to the original cost to assess the recapture. Similar rules apply where a partnership has a recapture event. In this case, a partner will have a recapture amount equal to the partner’s share of the lesser of (a) the amount that can reasonably be considered to have been included in respect of the property in computing the partnership’s credit amount), and (b) the percentage of the partnership’s credit amount in respect of the property, applied to either the proceeds of disposition of the property (if the property is disposed of to an arm’s length person) or the fair market value of the property at the time the property is converted to a non-clean technology use, exported, or disposed of (in any other case). The recaptured Clean Technology ITC is treated as taxes payable.

Leo Berwick Insights: As a significant relieving matter, the Bill has reduced the recapture period to 10 years from the 20-year period initially set out in the August Proposals. However, the recapture mechanics are very different from their U.S. counterparts which formulaically reduce the amount subject to recapture over time during the recapture period (also of note, the recapture period in the U.S. is only 5 years). Comparatively, the recapture rules proposed in the Bill could result in the same amount of recapture regardless of when a recapture event occurs within the recapture period, which is far more restrictive.

While not specifically addressed, the language in the Bill appears to consider a disposal recapture event only where the (i) taxpayer or (ii) a partnership of which the taxpayer is a member disposes of the applicable property. That is, where a TCC is the owner of the applicable property and is the Clean Technology ITC claimant, the sale of the shares of the TCC should not trigger a recapture event since the taxpayer (the corporation) has not disposed of the asset. Accordingly, reasonable exit alternatives for these assets may be limited to a sale of corporate stock in order to avoid Clean Technology ITC recapture.

Furthermore, the Bill does not contemplate a recapture event being triggered upon the sale by a partner of its partnership interest where the partnership is the owner of the applicable property. This is less restrictive than the U.S. rules where recapture is triggered on the selling partner’s allocable share of the U.S. investment tax credit that was initially claimed based on partnership property. However, if a partner transfers its partnership interest to a successor partner and a recapture event subsequently arises, then the successor partner will be liable for its share of the recapture amount. It appears this rule means that where a tax-exempt partner acquires an interest in a partnership from a TCC and the partnership subsequently realized a recapture amount (e.g., from eventually selling the partnership property), the tax-exempt partner could be liable for its share of the recapture amount. This is to be confirmed.

12. Labour Requirements

Similar to the recent U.S. rules released as part of the Inflation Reduction Act in 2022, the Bill includes several labour requirements that a taxpayer must satisfy in order to gain access to the “regular” tax credit rate of 30%. The labour requirements are elective. Failure to elect into or meet these requirements results in the taxpayer only being eligible for the “reduced” rate of 20%.

The labour requirements contain two components:

Prevailing Wage Requirements

- “Covered workers” (i.e., workers engaged in preparation/installation of the energy property; typically manual labour) must either be paid in accordance with an “eligible collective agreement”, or in an amount at least equal to the amount of regular wages and benefits specified in the “eligible collective agreement” that most closely aligns to the worker’s experience level, tasks and location. An eligible collective agreement is typically a multi-employer bargaining agreement that reflects the industry standard for a given trade. The Clean Technology ITC claimant must attest in prescribed form that it has met the prevailing wage requirements and that reasonable steps have been taken to ensure that covered workers of other employers (i.e., contractors) working on the designated work site are compensated based on prevailing wage standards.

- The Clean Technology ITC claimant must inform covered workers at the designated work site that the work site is subject to prevailing wage requirements.

- There is some relief provided in the event the CRA determines that prevailing wages are not paid. In such instances, the Clean Technology ITC claimant may pay a “top-up” amount to the covered workers in order to satisfy the prevailing wage requirements.

Apprenticeship Requirements

- Clean Technology ITC claimants must make reasonable efforts to ensure that apprentices registered in a Red Seal trade work at least 10% of the total hours worked by Red Seal workers at the designated work site. This requirement covers employees of the Clean Technology ITC claimant as well as employees of contractors and subcontractors.

- There is some relief provided where the Clean Technology ITC claimant cannot meet this requirement, for example due to labour laws or collective agreements restricting the amount of apprentices that may be used. In such instances, the claimant must make reasonable efforts to ensure the labour hours performed by apprentices registered in a Red Seal trade are as close as possible to 10% of the total hours worked by Red Seal workers at the designated work site.

- The Bill includes a set of rules that act as a safe harbour to deem a Clean Technology ITC claimant’s efforts to be “reasonable” for these purposes. In order to fall into the safe harbour, the claimant must undertake the following, at least every four months in years where a Clean Technology ITC is claimed:

- The claimant must post an advertisement seeking out the required apprentices to satisfy the apprenticeship requirements. The advertisement has to include a commitment to facilitate participation of the apprentices in a Red Seal program (or provincial equivalent). The advertisement must be open and accessible on the Job Bank and at least 2 other websites. The advertisement must be either continuously open throughout the year, or be open for at least 30 days each time it is posted. To the extent that contractors and subcontractors are involved in work at the designated work site, apprenticeship opportunities with those other employers would need to be included in the advertisement to satisfy these conditions.

- The claimant must communicate with a trade union, as well as a secondary school or post-secondary educational institution, for the purposes of facilitating the hiring of apprentice positions.

- The claimant must receive confirmation in writing that as many apprentices as were available have been provided as candidates for work at the designated work site. However, this requirement is in effect waived if the trade union fails to respond within five business days of a request. The claimant must attest to the above being met.

Leo Berwick Insights: These rules generally mimic the U.S. rules published in 2022. In our experience in the U.S. since the Inflation Reduction Act, the U.S. ITC labour requirements are insurable in some circumstances. Tax insurance could therefore have a role in Canada with respect to insuring the risk of labour requirements not being met for the 30% Clean Technology ITC. Furthermore, based on the trends in the U.S. market, EPC providers will be expected to adapt to these requirements and may be expected to provide contractual protections to sponsors/developers of clean technology sites to cover the risk of the Clean Technology ITC rate being clawed back due to failure to comply with the labour requirements. The Bill clarifies a number of detailed points in labour requirements. For instance, the Bill clarifies that the references to wages and benefits in the legislation refers to regular wages (without taking into account overtime). However, certain uncertainties remain. The Bill provides that the taxpayer claiming the Clean Technology ITC must make “reasonable efforts” to ensure that covered workers employed by other employers are paid prevailing wages. It is common for engineering, procurement, and construction (EPC) functions to be contracted out to specialized firms. In such circumstances, the Clean Technology ITC claimant would be on the hook for making reasonable efforts to ensure that covered workers of its EPC contractors are paid prevailing wages, even though such covered workers are not employed by the Clean Technology ITC claimant. The safe harbour rule described above only applies to apprentices. The Bill does not elaborate as to what “reasonable efforts” for covered workers entails, and this is a grey area that will need to be confirmed.

Another significant change in the Bill is that the penalty for failing to meet the apprenticeship labour hours requirement has been reduced to $50 per hour short from $100 per hour short as set out in the August Proposals.

13. Non-Arm’s Length Transfers The Bill includes a restriction on Clean Technology ITC-eligible costs arising from non-arm’s length transfers. In situations where an eligible property is acquired by a taxpayer (transferee) from a non-arm’s length person (transferor), the capital cost to the transferee for purposes of computing the Clean Technology ITC is restricted to the lower of (i) the amount paid, and (ii) the capital cost to the transferor.

Leo Berwick Insights: This directly restricts the ability to sell an asset at a premium from one related development company to another related operating company in order to boost the basis eligible for the Clean Technology ITC. This is a structure seen frequently in U.S. energy investments.

While this is restrictive, there may be opportunity to explore the potential benefits of retaining a non-controlling interest in both the development and operating side of the structure while ensuring that such arms of the structure are not related (e.g., by including arm’s length third-party investors). Leo Berwick will be exploring these opportunities over the coming months.

For illustrative purposes, consider a $100 premium above construction cost paid by an acquiror to a developer for a solar farm. Assume that the assets are sold just before substantial completion and their available for use date. The developer will recognize income on the sale and pay tax in the $23-31 range depending on its province. However, provided the assets are not considered to have been first used by the transferee, the acquiror will receive an extra $30 Clean Technology ITC (30% x the $100 premium) and also receive access to additional depreciable basis of $70 ($100 premium minus the $30 Clean Technology ITC, the undiscounted cash tax benefit of which is in the $16-21 range). As such, a transfer for fair market value generates net cash tax benefits, and investors will want to consider the possibility of retaining an interest in both sides of the structure to potentially obtain access to these additional benefits (subject to anti-abuse considerations).

The non-arm’s length rules also require related-party service charges such as a developer fee to be determined on a cost basis and exclude any charge through of employee remuneration based on profits or bonuses.

How Leo Berwick Can Help

Tax structuring to maximize Clean Technology ITC benefits

- Availability of basis step-ups to boost the capital cost eligible for the Clean Technology ITC, including consideration of non-arm’s length transfers prior to first use and/or substantial completion

- Optimal structuring for different investor types

Sponsor and developer tax modeling

- For a clean technology project with both taxable and tax-exempt investors, compare after-tax returns of a partnership structure vs. pure TCC structure

- Compare after-tax return of developer selling asset to third party vs. retaining an interest in the operations and claiming the Clean Technology ITC

- Consider impact to tax-exempts of holding investment in taxable structure (eligible for Clean Technology ITC) compared to flow-through structure (ineligible for Clean Technology ITC but tax-free)

Review Clean Technology ITC eligibility

- Consider specific capital costs and eligibility for Clean Technology ITC

- Perform valuation and cost analyses to support Clean Technology ITC eligibility

- Consider labour requirements

Tax insurance

Assist investors through the process of insuring key tax risks associated with investing in Clean Technology ITC-eligible projects, including:

- Cost eligibility

- FMV appraisal

- Acquisition/holding structure, including impact of transfers between entities under common ownership

- Prevailing wage and apprenticeship requirements

If you have further questions about the Bill or the Clean Technology ITC, please contact Steven Hurowitz, Partner (steven.hurowitz@leoberwick.com) and Zack Bhatia, CPA, Vice President (zack.bhatia@leoberwick.com).