An earn-out is an option sometimes used in an acquisition agreement that requires the buyer of a company to pay the seller additional compensation if the company achieves specified financial or operational goals, or meets other milestones by an agreed upon future date. Earn-outs are often used to bridge the gap between the buyer and seller when neither side can agree on a purchase price.

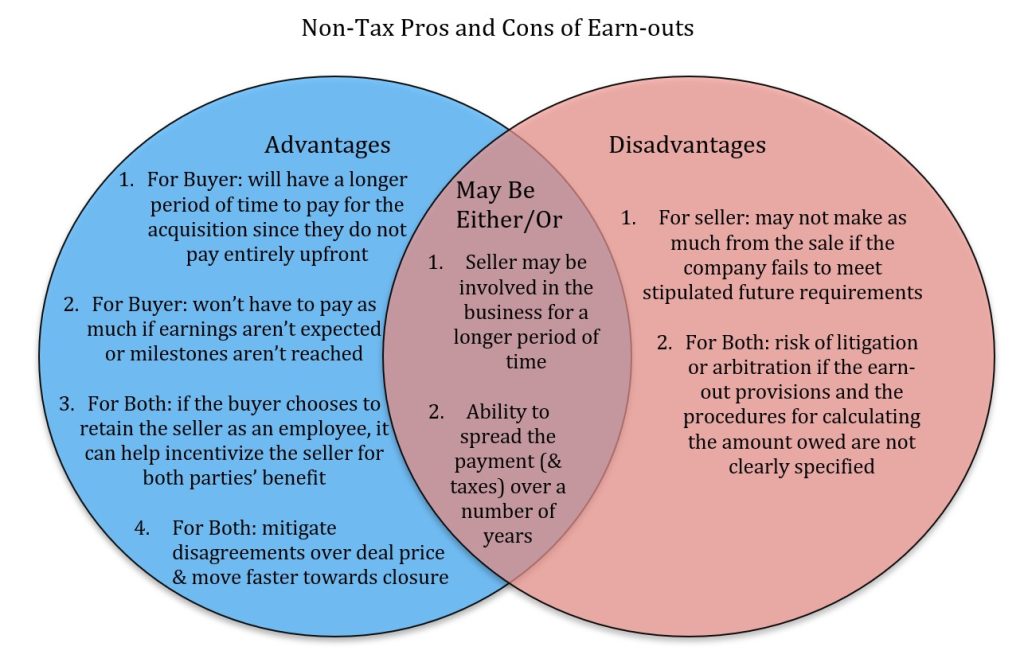

There are a number of other reasons either side might want to agree to an earn-out provision. A few of these (non-tax) reasons are illustrated in the diagram below:

Tax: Purchase Price or Compensation Expense?

Generally, an earn-out will be treated for tax purposes as part of the purchase price. However, if the selling shareholder will continue to provide services to the company, it is possible that the amount will be considered compensation for services.

From the seller’s perspective, treating the earn-out as a part of purchase price is a better result because the seller will be taxed at the lower capital gains tax rate. Further, there will be no employment taxes imposed

By contrast, the buyer would likely prefer for the earn-out to be treated as compensation because the company will get a compensation deduction while no deduction is available for payment of purchase price. Note, however, that if the earn-out is viewed as compensation, it would be necessary to consider the impact of other related tax provisions such as Section 280G (golden parachute rules that may limit the amount of deduction) and Section 409A (income inclusion if the arrangement does not comply with the deferred compensation rules).

Whether an earn-out will be considered compensation or part of the purchase price requires an analysis of the facts and circumstances. Some of the factors the Internal Revenue Service may consider include the following:

- Is the selling shareholder required to perform services in order to receive the earn-out?

- Are the earn-out payments proportionate to the selling shareholder’s equity in the company?

- Is the seller already being paid reasonable compensation for the post-closing services?

- How are the parties reporting the amount for tax and financial statement purposes?

- During negotiations, did the parties disagree on a purchase price and subsequently the earn-out is proposed? This may be a factor supporting the characterization of the earn-out as part of the purchase price.

What is the tax advisor’s role in constructing an earn-out provision?

Given that buyers and sellers will favor different tax characterization of the earn-out payment, parties should start consider this issue early in the planning process. A tax advisor can assist in the analysis of the facts surrounding the transaction and provide recommendations as to how to structure the earn-out to obtain the tax results desired.